This can take between 10 minutes and 2 days depending on how much information they need from you. The downside to using a transfer company outside of a bank is that you’ll have to set up an account with them first. This is because they offer better exchange rates and lower (and sometimes no) fees. Money Transfer Companies like XE and WorldRemit are often the cheapest option when you are sending between $1,000 and $1,000,000 at a time. They are cheaper and faster than using banks. Wise (formerly known as TransferWise) and CurrencyFair are two of the biggest companies that offer P2P transfers and send your money this way. Instead of wiring money overseas through a bank, P2P companies that make these types of transfers match people buying currency in one country with people who are selling it in another. Using a bank is also the quickest way to transfer money internationally. What other options are there to transfer money internationally?īanks in Australia have higher fees and uncompetitive exchange rates but this doesn’t mean you should never use them. It’s worth doing some research and comparison to check you’re getting a fair deal. Tip: Fees vary depending on where the payment is being sent from, the method of payment (bank account/PayPal balance, debit card or credit card) and the payment destination.

The essential takeaways are that you and / or the person receiving the money can expect to pay anything between 0.5% and 7.5% in fees to transfer money internationally (before taking exchange rates into account).īecause PayPal tends to charge percentages, rather than fixed fees, the more money you transfer, the more you will end up paying in fees. With 23 major headings, over 20 tables and over 8,000 words, it’s not for the faint-hearted. To say PayPal’s Australian fee structure is complicated would be a big understatement. $10,000 payment/transfer with credit card or debit card = $5.99 + $260 + $0.30 or £0.20 + currency conversion.$10,000 payment/transfer with PayPal account or bank account = $5.99 + currency conversion.$1,000 payment/transfer with credit card or debit card = $5.99 + $26 + $0.30 or £0.20 + currency conversion.$1,000 payment/transfer with PayPal account or bank account = $5.99 + currency conversion.$100 payment/transfer with credit card or debit card = $5 + $2.60 + $0.30 or £0.20 + currency conversion.$100 payment/transfer with PayPal account or bank account = $5 + currency conversion.This funding fee has no cap so can get very expensive.Įxample: Sending money from Australia to the US, UK or Canada An funding fee of 2.6% of the funds transferred + fixed fee + currency conversion if you pay with credit or debit card.A transaction fee of 5% of funds transferred with a minimum of $0.99 and maximum of $5.99 for the transaction fee from a PayPal account or a bank account linked to PayPal Money can be deposited to a Paypal account through a checking account or credit card You need to have one of checking account, savings account or bank debit card to send money to a Netspend account Bad ratings, or a non-existent company, are a red flag With Userlytics, you can get paid via PayPal to test websites and apps for their user.Here are the fees typically charged by PayPal for international transfers. I know I am like a dinosaur and don't like the change but I am a very loyal paypal customer.Frequently Asked Questions How are PayPal fees calculated? Enter the recipients email address or mobile number, and the amount and currency to send.

#Paypal send money crack

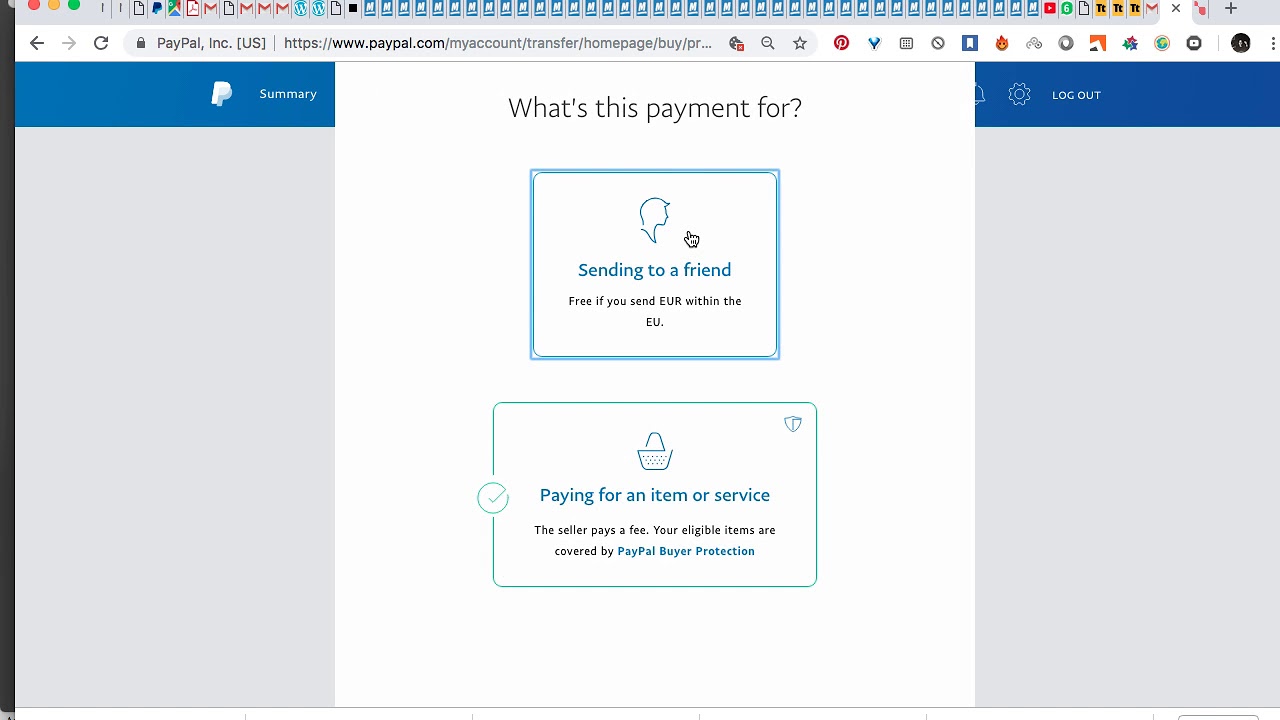

I just want to help, so fewer people will fall into the crack to feed the greedy corp. I do not need kudos or any thumb up or anything. Anyway, this may not be new but hope it help someone who has this issue and does not want to be robbed by greedy corp like paypal. I think paypal engineer purposely hide this option to charge fee for innocent people. Finally I accidentally hit the gift and discover the option to use purchase protection or send to someone you trust. I keep trying back and forth but I can not find the option of family and friend anywhere on the web including this paypal forum. Transaction fees can be high, especially on low-cost purchases International transfer fees are pricey PayPal often holds funds for 72 hours before you can.

Paypal has darn changed the user interface so it automatically use purchase protection and charge receiver fee as merchant or seller. First I thought my account was accidentally set as a merchant account or business account so paypal charge fee for merchant. I am shocked to see only $0.67 in my account. My wife create an account today and send me $1.00 just for the heck of testing if the account work as expect.

0 kommentar(er)

0 kommentar(er)